In January 2021, Jasmine Taylor was a struggling 29-year-old with more than $78,000 of debt looming over her — $60,000 in student loans, $9,000-$10,000 in credit card debt, and $8,000 in medical bills. With her 30th birthday around the corner, Taylor knew she needed to take control of her finances.

So she began by taking stock of her finances. She analyzed her debt, income and expenses and researched different budgeting styles before settling on cash stuffing. This practice allowed her to evaluate her finances honestly and gave her a clear picture of where she stood.

What Is Cash Stuffing?

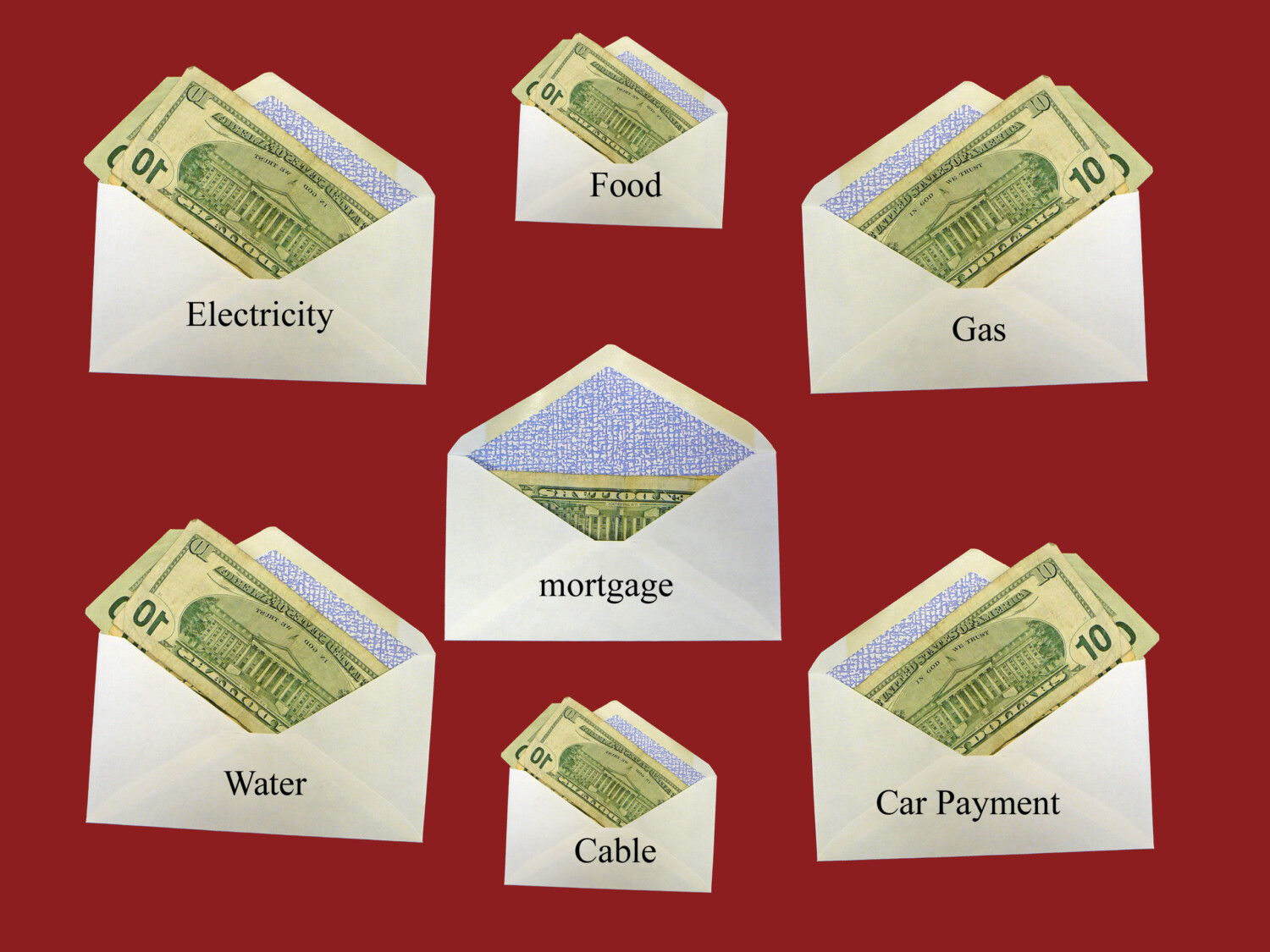

Cash stuffing, or the “envelope system,” is a popular budgeting method that has gained traction in recent years. It entails setting up envelopes for different categories of expenses, such as rent, groceries and entertainment, and using physical cash to stick to these spending limits. The cash stuffing approach is based on the idea that physically handling money and categorizing it into envelopes makes you more aware of your spending habits and better able to manage your finances.

When adopting cash stuffing, Taylor opted for a zero-based budget. This means that she allocates every dollar of her paycheck for a specific purpose. Taylor sets up envelopes for each category of her expenses, including bills, variable costs and sinking funds. Sinking funds function like short or long-term savings accounts for specific expenses such as car maintenance, emergency funds or holiday expenses.

Cash-Stuffing Is Having A Social Media Moment

Cash-stuffing isn’t new, but the method has gained widespread popularity on social media platforms due to its effectiveness, simplicity and more high-profile success stories in debt reduction and financial freedom.

Cash stuffing requires discipline and dedication, but if done correctly, it can help you reach your financial goals. It can be a simple yet effective approach to managing your finances if you struggle with overspending or sticking to a budget.

Financial experts told Insider that it relieves the stress people feel from mental accounting; you know where your money is going and bills are taken care of. It even allows you to better prioritize self-care, because you’ve decided in advance where all your money is going.

Here’s one of Taylor’s TikToks on @baddiesandbudgets, in which she shows how she allocates her money and stuffs it into an organizer.

@baddiesandbudgets How I pay my Bills. #cashstuffing #budgetbinder #budgetplanner #cashenvelopes ⬠original sound – Cash Stuffing & Budget Binders

Turning Cash Stuffing Into A Business

Within a year, Taylor made significant progress toward financial freedom. Not only did she manage to pay off $23,000 of her student loan debt and clear all of her medical bills and credit card balances, but she also put her own creative spin on cash stuffing.

Taylor started her TikTok account and YouTube channel to document her journey and to hold herself accountable for her financial decisions. She felt that being transparent about her finances and sharing her methods with others would not only keep her on track but inspire others also to take control of their finances.

“I started out making my own items for my own budget and more people were just interested in asking where can I get these things,” she told “Good Morning America.” “I bought a Cricut, I bought some inventory, hosted my Shopify site and I just started.”

Taylor began selling budgeting courses, beginners’ cash-stuffing kits, binders, wallets and other accessories. Eventually, she turned Baddie and Budgets into a thriving business.

Word of mouth and Taylor’s social media presence have been crucial to the company’s success. In 2022, Baddies and Budgets made around $850,000, and this year, it’s on track to hit $1 million in revenue.

How To Start Cash Stuffing

The cash stuffing method can be an effective way to pay down debt and begin building financial security. This method requires dedication, discipline and good budgeting skills.

To get the most out of it, users should create an emergency fund in case of unexpected expenses, keep track of their spending, automate when possible and seek advice from professionals. Additionally, as Taylor has shown, it can be helpful to be accountable to stay motivated throughout the process.

If you’re interested in trying this process out, here’s a video Taylor put together to help beginners:

This story originally appeared on Simplemost. Check out Simplemost for additional stories.